All Categories

Featured

Table of Contents

On the various other hand, if a customer requires to attend to an unique needs child that may not have the ability to handle their own cash, a trust fund can be included as a beneficiary, allowing the trustee to handle the distributions. The kind of recipient an annuity proprietor selects impacts what the beneficiary can do with their acquired annuity and just how the proceeds will be strained.

Numerous contracts permit a spouse to determine what to do with the annuity after the owner passes away. A partner can alter the annuity contract into their name, assuming all rules and civil liberties to the preliminary agreement and postponing instant tax obligation consequences (Annuity contracts). They can collect all continuing to be settlements and any kind of fatality benefits and select recipients

When a spouse ends up being the annuitant, the spouse takes over the stream of payments. Joint and survivor annuities also allow a called recipient to take over the agreement in a stream of payments, rather than a lump amount.

A non-spouse can just access the designated funds from the annuity proprietor's initial arrangement. In estate preparation, a "non-designated beneficiary" describes a non-person entity that can still be named a recipient. These consist of trust funds, charities and various other organizations. Annuity owners can select to mark a trust fund as their beneficiary.

What types of Variable Annuities are available?

These distinctions mark which recipient will obtain the entire survivor benefit. If the annuity proprietor or annuitant passes away and the key recipient is still alive, the primary recipient gets the survivor benefit. If the main recipient predeceases the annuity owner or annuitant, the fatality benefit will certainly go to the contingent annuitant when the owner or annuitant passes away.

The owner can alter beneficiaries at any moment, as long as the agreement does not require an irreversible beneficiary to be called. According to experienced contributor, Aamir M. Chalisa, "it is very important to comprehend the importance of assigning a recipient, as choosing the wrong recipient can have severe effects. A lot of our customers choose to call their underage youngsters as beneficiaries, typically as the key recipients in the lack of a partner.

Owners that are married ought to not think their annuity instantly passes to their spouse. Usually, they go through probate. Our brief test offers clearness on whether an annuity is a wise selection for your retirement profile. When selecting a recipient, consider factors such as your connection with the person, their age and how inheriting your annuity might affect their monetary circumstance.

The recipient's relationship to the annuitant typically determines the regulations they follow. For instance, a spousal recipient has even more alternatives for handling an inherited annuity and is dealt with even more leniently with tax than a non-spouse recipient, such as a kid or various other member of the family. Annuity riders. Suppose the proprietor does make a decision to call a child or grandchild as a recipient to their annuity

Who has the best customer service for Lifetime Income Annuities?

In estate preparation, a per stirpes classification specifies that, needs to your recipient die before you do, the recipient's descendants (youngsters, grandchildren, and so on) will certainly obtain the survivor benefit. Get in touch with an annuity expert. After you've chosen and called your beneficiary or recipients, you should proceed to review your selections a minimum of as soon as a year.

Maintaining your designations up to day can guarantee that your annuity will be managed according to your desires should you pass away all of a sudden. A yearly review, major life occasions can prompt annuity owners to take another look at their beneficiary choices.

What types of Fixed-term Annuities are available?

Similar to any type of economic item, looking for the aid of a financial advisor can be advantageous. A financial coordinator can guide you via annuity administration procedures, consisting of the approaches for updating your agreement's recipient. If no recipient is named, the payment of an annuity's survivor benefit goes to the estate of the annuity holder.

To make Wealthtender complimentary for viewers, we make money from marketers, including financial specialists and firms that pay to be included. This develops a conflict of interest when we prefer their promo over others. Review our editorial plan and regards to solution to find out a lot more. Wealthtender is not a client of these monetary providers.

As an author, it is just one of the very best praises you can provide me. And though I actually appreciate any of you spending several of your active days reviewing what I write, slapping for my write-up, and/or leaving praise in a comment, asking me to cover a topic for you genuinely makes my day.

It's you stating you trust me to cover a subject that is very important for you, and that you're certain I 'd do so better than what you can already find online. Pretty spirituous stuff, and an obligation I don't take likely. If I'm not acquainted with the subject, I investigate it on the internet and/or with calls that understand more concerning it than I do.

What should I look for in an Secure Annuities plan?

Are annuities a valid recommendation, a shrewd step to safeguard guaranteed income for life? In the most basic terms, an annuity is an insurance coverage product (that only certified representatives may offer) that guarantees you month-to-month repayments.

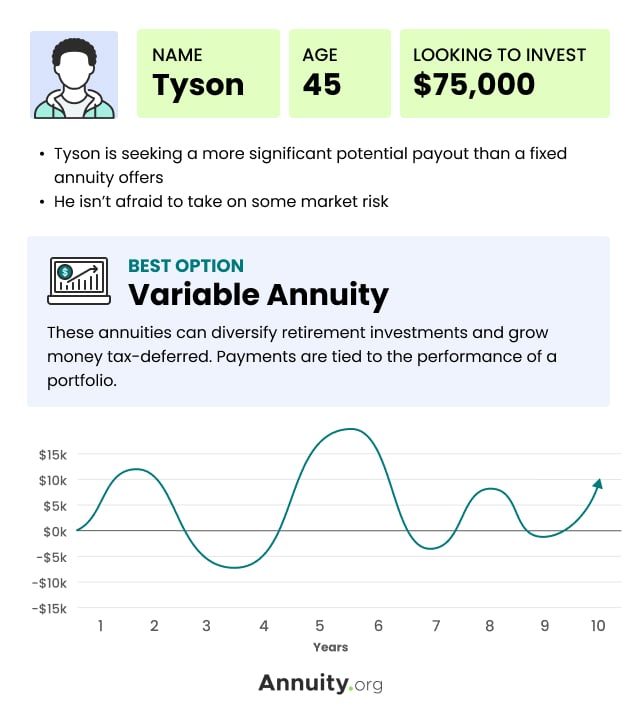

This usually applies to variable annuities. The even more riders you tack on, and the less danger you're eager to take, the reduced the payments you ought to anticipate to obtain for a provided premium.

What is the most popular Retirement Income From Annuities plan in 2024?

Annuities picked appropriately are the ideal option for some people in some circumstances. The only method to understand for sure if that includes you is to first have a comprehensive monetary plan, and after that determine if any kind of annuity option supplies enough advantages to validate the expenses. These costs consist of the dollars you pay in premiums of training course, but also the possibility cost of not spending those funds differently and, for much of us, the effect on your eventual estate.

Charles Schwab has a great annuity calculator that shows you about what settlements you can get out of fixed annuities. I utilized the calculator on 5/26/2022 to see what an instant annuity may payout for a solitary premium of $100,000 when the insured and partner are both 60 and stay in Maryland.

Table of Contents

Latest Posts

Understanding Financial Strategies A Closer Look at Choosing Between Fixed Annuity And Variable Annuity What Is Fixed Vs Variable Annuities? Benefits of Choosing the Right Financial Plan Why Deferred

Understanding Financial Strategies A Closer Look at How Retirement Planning Works Defining Annuity Fixed Vs Variable Advantages and Disadvantages of Annuities Variable Vs Fixed Why Fixed Index Annuity

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Annuity Fixed Vs Variable Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Or Variable Annuit

More

Latest Posts